Kathleen Tamburino South Florida hot real estate market opportunities today: A recent Redfin report throws the spotlight on Florida’s condo market, revealing some interesting shifts that are reshaping the landscape for owners and buyers alike. Data from real estate brokerage Redfin shows a whopping 28.2% jump in the number of condos for sale in January, which is a stark contrast to the 11.1% increase nationwide. The culprits? Soaring insurance and homeowner association (HOA) fees. Because of rising Association fees and increasingly-common special assessments, condos are taking much longer to sell. While Florida’s median sales prices for condos nudged up by 2.4%, thats less than the 8.4% growth for condos nationwide. Median prices for condos fell 6.5% in Jacksonville, by 4.8% in Orlando, 2.5% in Miami and by 1% in Tampa. See more details on https://about.me/kathleensellsflorida.com.

Renovating increases the house value says Kathleen Tamburino : Most materials come in standard pack sizes, so quantities of things like insulation, bricks and blocks need to be rounded up. Contractors know that an allowance needs to be made for breakage, both in delivery and on site. Reclaimed materials for renovation projects have an even higher wastage factor. You may need to over-order by up to 20 per cent on second-hand bricks, slates and tiles compared to around five per cent for new. Better order too much than not enough. Any surplus can usually be sold or returned. Renovation work always costs more than you expect. This is because some problems are not revealed until you start work and uncover them, but mostly because items are forgotten from the budget, or because you change your mind and alter the design or specification.

Next up: home price trends. In November 2020, existing home prices grew by a whopping 15% compared to last year—rising to a national median of well over $300,000! This marks more than 100 straight months of year-over-year price gains.4 Sellers, this should put a big smile on your face! And hang tight, buyers—we have some advice for you too. If you’re going to buy a home in this expensive market, you absolutely must find out how much house you can really afford. Commit to staying within that budget amount no matter how much pressure you feel watching competitors pluck good homes off the market.

Excellent Florida real estate guides 2024 from Kathleen Tamburino: Now that you know the “fair market value” of the home you like, it’s time to determine how much you are willing to pay. Establishing this prior to making a formal offer helps define your personal limits. You should determine how much to offer, how much earnest money you will put down, how much of the closing costs you will ask the seller to pay, when you plan to settle, and what inspections you plan to have conducted. Your agent will offer great advice for structuring your offer. Remember to ask your agent about contingencies and their importance. If you don’t fully understand something, be sure to clarify it.

Start Investing: Investing is one of the best ways to increase your net worth, but a lot of people stay away from it because they’re scared of losing money. So instead of investing, they keep their money in a savings account. That’s great, and you should have some money in a savings account for emergencies, but the truth is: Money in a savings account loses value over time. See, the average savings account has a very tiny 0.06% APY (annual percentage yield), while inflation is around 1.7%. That means that each year, the money you have in a savings account is going to have less and less buying power. So, what can you invest in to stay ahead of inflation? Here are some options: Real estate, Peer-to-peer lending, Exchange traded funds (ETFs), Stocks. See extra info on Kathleen Tamburino.

Recommended South Florida real estate tricks today with Kathleen Tamburino: I highly recommend sketching and planning every inch of your project before you begin. Every time you change your mind it will cost you time and ultimately money. We only have one significant change throughout our entire home renovation process and while I knew it was the best decision, it still cost us. Make up your mind and don’t change it. While I didn’t want to deal with sourcing materials on my own, I do understand why so many people pay contractors for labor only and take care of materials themselves. Contractors often have a premium that they add on top of certain items when they purchase them and you can end up paying upwards of 30% more for certain materials. It’s best to hire for labor only.

Buying real estate in a good school district makes it a lot easier when it comes time to sell your house in the future. Whether you’re looking to downgrade as an empty nester or upgrade into a larger house to support your family, a top school district is a big-time selling point in real estate. If you buy in a bad school district you run a greater risk of your home depreciating because you are appealing to a much smaller buyer pool. We recommend our buyers focus on specific neighborhoods vs. focusing on cities or larger areas. The neighborhood you live in is going to have a direct impact on you. What are you looking for in a neighborhood? Address this question early on in the home buying process because buying in the wrong neighborhood is a surefire way to be remorseful about buying a house.

Here are several real estate guides: While you’re at it, you should check your credit scores (all 3 of them) and determine if anything needs to be addressed. As I always say, credit scoring changes can take time, so give yourself plenty of it. Don’t wait until the last minute to fix any errors or issues. And while you’re addressing anything that needs more attention, do yourself a favor and put the credit cards in the freezer (or somewhere else out of reach). Lots of spending, even if you pay it back, can ding your scores, even if just momentarily. It can also increase your DTI ratio and limit your purchasing power. Ultimately, bad timing can create big headaches. Additionally, pumping the brakes on spending might give you a nice buffer for closing costs, down payment funds, moving costs, and renovation expenses once you do buy.

Everyone is on social media sites these days and Facebook is a great way to network and connect with buyers. In addition to the marketing effort your Realtor will provide, you can also use the power of networking to get the word out to as many people as possible that your home is for sale. People also love watching videos. If you grab your phone or video camera, make a video as you walk through your home and your neighborhood. Tell why you love it and then post that video on FB and YouTube. By doing so, you will help a prospective buyer visualize a great life living there also.

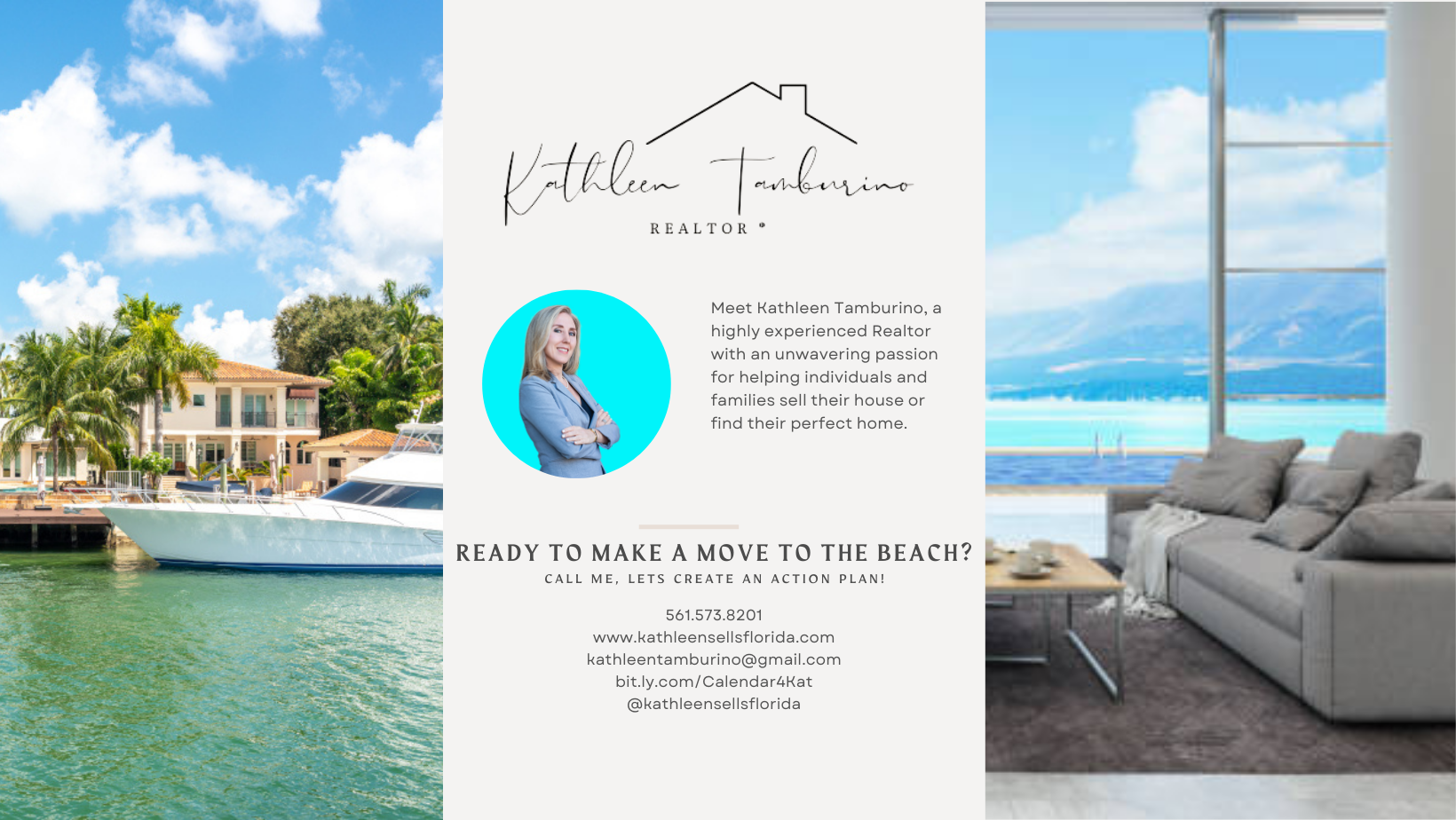

Buying or selling a home in Florida is a legal transaction that requires expertise, understanding, and a desire to do right for your client. Kathleen brings her home buying and selling clients a unique experience and understanding of real estate. Once you become Kathleen’s client, she will think about you 24/7 until she meets all your real estate needs. As a former Business Education Teacher in NYC, she offers a dedication and tenacity you will not get with any other real estate agent.

Kathleen is focused on providing you with the best results and service in the industry. She listens carefully to understand your real estate goals and works hard to create solutions that make sense for you. Whether you are new to the market or an experienced investor, Kathleen has the expertise and resources to help you achieve your real estate goals. She understands that buying or selling a home can be a stressful and overwhelming process, which is why she makes it her top priority to guide her clients through every step of the transaction with patience and professionalism.

As is often said, real estate is about location. Kathleen has extensive knowledge of the Palm Beach County, FL area and can help you find the right home for you or the right buyer for your home.